Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Last week, markets posted broadly negative performances due to concerns over the potential effects of a U.S. credit rating downgrade by Fitch (to AA+ from AAA). The downgrade was simply a global broadcast of the U.S. fiscal situation - no surprise, it is not good, but in our opinion, it is still better than the rest. Exacerbating the fiscal issue, we learned this week that the U.S. Treasury Department will issue ~$1T to finance higher spending. The previous estimate was $733B. The 10-year yield is now up more than 30bps since late June.

The S&P 500 is up nearly 18% YTD, led almost entirely by valuation expansion, where despite higher interest rates, the P/E multiple on the S&P 500 has expanded to 19x. Thus far, economic growth has been more resilient than many investors expected, especially given the Fed’s rate hike cycle. Incoming statistics, however, show signs of cracks forming, and the 10-year yield ripping higher usually isn’t a boon to equity markets.

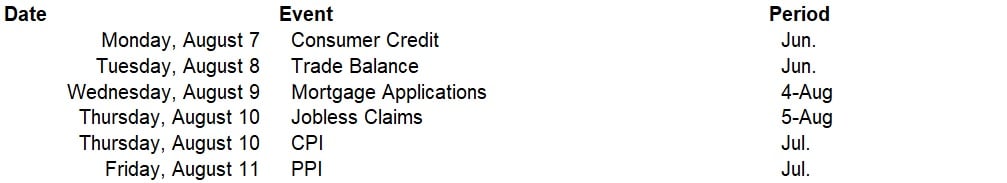

This week, the main focus will be on the inflation data, with the July CPI report out on Thursday and PPI on Friday. Softness in core inflation this week would support the popular notion that the current hiking cycle is over. Continuing disinflation on top of the labor market weakness from last week should convince the Fed to keep rates on hold at their next meeting in September.

Data deck for August 5 - August 11: