Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Another disappointing week for markets last week, with equities down for the fourth week in a row. Inflation and central bank policy concerns, earnings results, slowing economic growth, and the ongoing war in Ukraine continue to combine and drag markets down. The S&P 500 fell 3.3% last week and looks to be in some distress, closing below the lows set in mid-March.

For the first time in several years, higher-valuation tech companies have had high-profile disappointments as bellwethers such as Apple, Amazon, and Netflix upset markets after reporting quarterly earnings and guidance last week. Over the past four weeks, the tech-dominated Nasdaq has fallen 13.3%, the worst monthly decline since 2008.

Despite the negatives, this earnings season has broadly been a positive one. With over half of the S&P 500 reporting, 80% have topped earnings expectations, with EPS 7% above expectations. Though last week highlighted gyrating volatility and a continued painful re-marking of valuations against a backdrop of higher interest rates, we believe it also highlighted the importance of maintaining a well-diversified portfolio across all asset classes- including bonds, alternatives, real estate, and cash-generating equities. It’s still remarkable to us how quickly investor sentiment and narrative in markets can change, and we believe well-diversified portfolios allow investors to withstand and take advantage of the pendulum swings in market and investor sentiment.

Several major central banks will deliver policy decisions this week; however, all eyes will be on the Fed. In his press conference on Wednesday, we expect Chair Powell will continue repeating the Fed’s recent concerns about the inflation-generating process and overheating labor markets. With markets expecting ten 25bps rate hikes by the end of the year, while the Fed suggests six, it’s become clear that there are no signs of the Fed slowing down its current cadence for tightening. In our view, however, it remains to be seen how much of what is currently already “priced in” to markets will materialize. In addition to other economic events on the agenda this week, it’s worth highlighting the monthly OPEC meeting that will be on Thursday. With oil contributing to inflation, this could also be a highly eventful week for oil markets and thus everything affected by inflation – namely most asset classes.

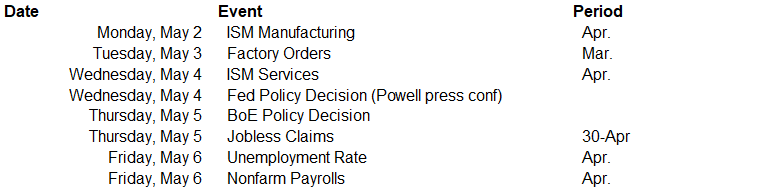

Data deck for April 30 - May 6: