Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Last week, markets had another turbulent time digesting language and speeches from the Fed. Higher yields in fixed income markets continue to weigh on global equity markets as the S&P 500 fell 1.3% last week amidst global equity market struggles.

Fighting persistent inflation remains the Fed’s most important task, and last week, the FOMC Minutes further addressed that aim. It laid out a framework whereby the Fed would start to run off its balance sheet alongside aggressive rate hikes.

In the FOMC discussion on monetary policy, it is worth highlighting that “many participants” would have preferred a 50bps hike in March, but “a number” then judged a 25bps increase appropriate due to the uncertainty associated with the Russian invasion of Ukraine. Additionally, “many participants” noted that “one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.”

In our view, the FOMC minutes all but confirmed that a 50 basis point rate hike is coming at the next FOMC meeting, with more likely to follow.

While an aggressive Fed has been widely accepted and priced into fixed income markets, it remains to be seen just how far the Fed is willing to go in curbing inflation at the potential expense of economic growth. We believe some market participants are falling into the folly of extrapolation of recent events, and blind belief in such is often dangerous. In our view, the pendulum of expectations warrants increased scrutiny in the current environment.

Many important data releases are on the agenda this week in the U.S. Primary focus, however, will be on inflation, with the release of the CPI, PPI, and import prices for March, all expected to show significant increases. More soundbites from Fed Governors are also on tap this week as Fed-speak communication policies continue to confirm support for rapid policy normalization.

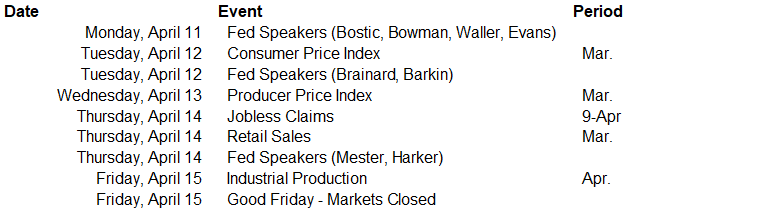

Data deck for April 9 - April 15: