Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Equity markets continued their slump last week, with the S&P 500 down 3.0%. With little to change the narrative on inflation, tightening monetary policy, or cooling growth, investor sentiment remains very poor. Last week marked the seventh week in a row that the index has been down, a stretch not seen since March 2001.

The Fed wants to tighten Financial Conditions as a mechanism to slow the pace of the economy and, in turn, lower inflation. It recently warned taming inflation would “include some pain.” That said, leading business confidence indicators in the U.S. have already started to fall, anticipating lower activity ahead. There are also signs that the housing market may be cooling. In our view, the adjustment of the U.S. economy is underway, and much lower growth rates should be expected throughout the year.

Some constructive green shoots have emerged lately, however. U.S. inflation expectations have fallen, commodities appear to be leveling off, and supply chain problems are set to ease with the partial re-openings in China. Furthermore, bond yields have paused their ascent and have begun to provide some relief. Some of their income and safe haven attributes are returning as fears shift a little from inflation to slowing growth. We view such a shift as a positive step for markets.

As we head into a holiday week for the U.S., the economic releases to keep an eye on include some early May PMIs to gauge the speed of global growth momentum. Personal income and spending, PCE inflation, new home sales, and durable goods orders are worth keeping an eye on. However, much of the focus will be on the May FOMC meeting minutes, to be released on Wednesday. The minutes of the May meeting will be important in clarifying the consensus formed regarding the speed of rate hikes and the conditions for moving away from 50bps hikes in the summer.

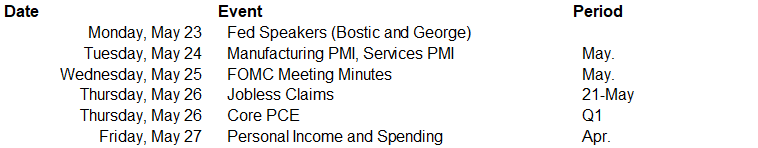

Data deck for May 23 - May 27: