11 minute read

With the calendar now officially reading 2021, we recognize that we have lived through an incredible period in history. The pandemic weighed heavily on us last year and still does today. But this quarter – the first of the new year – we look back at the past 12 months and lay out our investment outlook for 2021. While many risks remain, the effective vaccines that are starting to be distributed provide a real beacon of hope for the adrift ship that was 2020.

We said in the last few weeks of the first quarter of 2020 that we would get through this crisis and that things would improve and recover. Financial markets recovered first, and quicker than they ever have from such a deep economic hole – and quicker than anyone could have hoped. The economy has made great progress too but is not back to pre-COVID-19 levels yet, and may not be for another year or two. On the health side, the authorities warn us we may be in for dark days this winter before the vaccines can be widely available to the general public and as new strains surface. This may set back economies and markets in the near term, and keep us isolated and following prolonged stay-at-home orders for the foreseeable future. But we expect that in 2021 we will see the end of the pandemic, and our society can then follow the markets and the economy in bouncing back as well. In the meantime, we hope that you and your loved ones stay safe and healthy. With that as a backdrop, let’s look at the markets in more detail, but reader beware: this commentary gets into the technical detail, which we think provides the necessary supporting data to validate this remarkable year.

Fourth Quarter & 2020 Market Recap

Even in the face of a challenging and turbulent year, our portfolio strategies performed well. Global stocks such as the MSCI ACWI ETF ended the year at all-time highs, with a 16.3% gain. During the dark days of March, with pandemic fears rampant and the global economy falling off a cliff, very few people would have predicted this outcome. And we would not have either, as our investment philosophy demands that we avoid short-term market predictions. What we did write in our first quarter commentary was to stay the course. This is generally a wise approach for long-term investors following a disciplined strategy. And it proved to be the case once again.

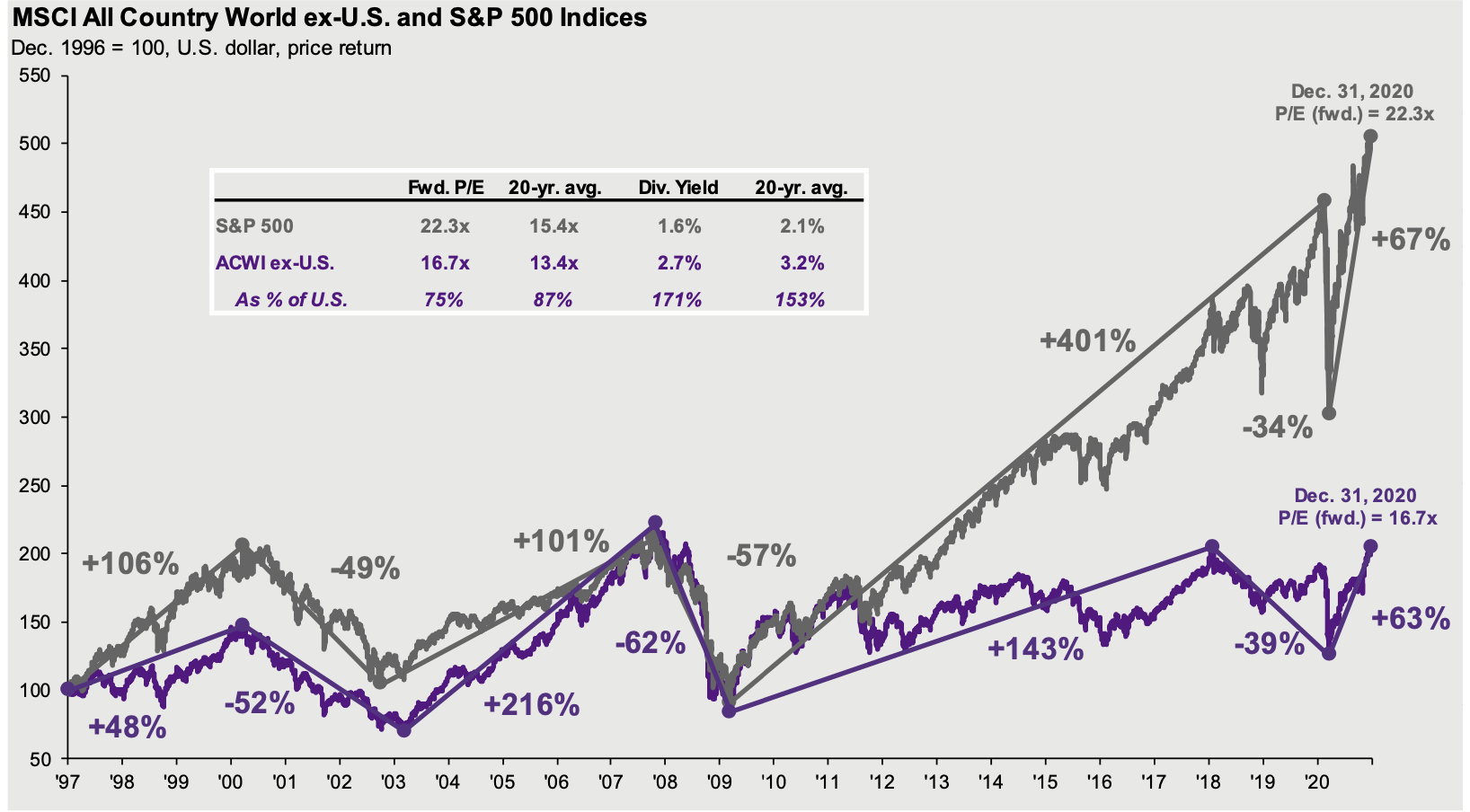

In 2020, U.S. stocks led the major equity markets. The S&P 500 gained 18.2%, and small-cap stocks as measured by the Russell 2000 ETF went up 20% for the year. Another sector referred to as developed international stocks gained 9.7% while emerging markets stocks rose 15.2%. In the fourth quarter, foreign stock markets were particularly strong, with gains in the mid-teens, outperforming U.S. stocks (i.e., the S&P 500) by several percentage points.

The comforting returns experienced for the full year mask the incredible volatility and stress investors faced earlier in the year. Stock markets around the world were down between 30% and 40% from January 1 to the market bottom on March 23, in what was the quickest/sharpest bear market in history. From the low point, stocks skyrocketed into year-end. The S&P 500, developed international, and emerging markets stock indexes all roared back more than 65%. Small-cap U.S. stocks soared nearly 100%.

The story wasn’t all about equities, however. In fixed income, core bonds gained a strong 7.6% for the year, providing positive returns both during and after the market crisis period. The 10-year Treasury yield touched an all-time low of 0.5% in August and ended the year at 0.93%, roughly a full percentage point below where it started in 2020. In credit markets, high-yield and other investment grade bonds posted positive returns, albeit lower than core bonds. Both credit sectors outperformed core bonds in the second half of the year but still have some ground to make up from the tremendous credit market dislocations in March before the Federal Reserve came to the rescue.

More broadly, our portfolio strategies produced strong performance, as financial markets recovered from the sharp pandemic-induced selloff and started signaling a global economic recovery. In addition to strong U.S. equity performance, our international equity funds had a strong year, outdistancing their benchmarks, though, while being pleased with this there is no assurance it will continue.

There never being any guaranty as to future profits, based upon current conditions, we remain confident that our investment approach, with our focus on risk control and a strict valuation discipline, will lead us to opportunities which will serve our clients well over the long term as discussed in our outlook below.

Backdrop and Outlook: 2021 & Beyond

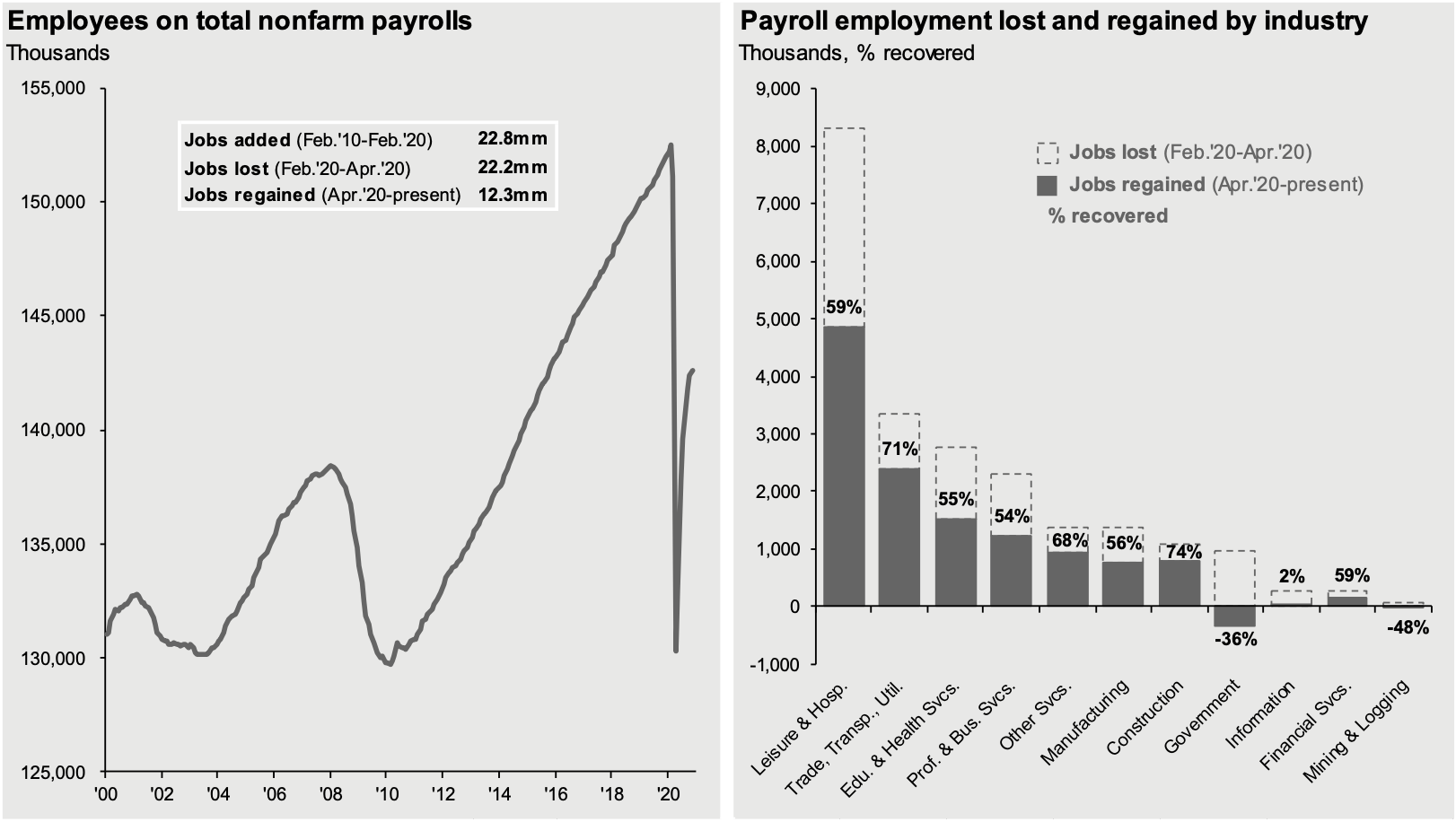

Any discussion of the 2021 outlook must still begin with the COVID-19 health crisis and its recent “third wave” resurgence in the United States and “second wave” surge in many other countries, particularly across Europe. The public health impact in the United States is increasingly severe, reaching all-time highs in daily deaths and current hospitalizations. This is leading to increasingly aggressive – albeit still localized – economic lockdowns across the country. And that raises the risk of a sharp slowdown in the economy, if not an outright contraction, heading into 2021. Recent weak labor market data, falling household income, and slumping retail sales indicate this is already happening in January. At its mid-December meeting, the Fed reiterated yet again that “the path of the economy will depend significantly on the course of the virus and what is really needed is fiscal policy.”

After months of political back-and-forth, congressional Republicans and Democrats reached agreement in the eleventh hour on a compromise $900 billion pandemic relief bill. Among its key provisions, it will make direct payments of $600 to qualifying individuals, extend $300 per week in extra unemployment benefits through mid-March, and authorize nearly $300 million in forgivable loans to small businesses. As we write this, the Democrats have won the January 5 special runoff for Georgia’s two U.S. Senate seats and are set to control the narrative in the next two years. This will likely result in larger fiscal stimulus – including larger direct payments to qualifying individuals, including money for strapped state and local government budgets as well as larger infrastructure spending. And as incoming Treasury Secretary and former Fed Chair Janet Yellen stated, we expect fiscal stimulus to follow the “go big” mantra.

While the economy faces these very-near-term dangers, the likelihood of widespread distribution of effective vaccines in the first half of 2021 supports the case for a relatively strong economic rebound beginning in the second or third quarter. Successful vaccine distribution will undoubtedly be required for governments to lift lockdowns and alleviate the pent-up consumer and business spending. The IMF currently forecasts 5.2% global real GDP growth in 2021; this compares to a -4.4% global economic contraction in 2020 and 2.8% growth in 2019. For the U.S. and emerging markets, the IMF forecasts 3.1% and 6% real GDP growth, respectively, in 2021. We expect any surprise to be on the upside given the large fiscal stimulus that will likely be unleashed with the Biden administration. All the GDP estimates are well above long-term historical average growth rates.

Monetary Policy

Even if these forecasts are in the ballpark and we do get a decent economic recovery in 2021, monetary policy is almost certain to remain very accommodative. The Fed continues to communicate it is far from seeing a need to start tightening policy, in terms of either raising the federal funds rate (currently near zero) or reducing its quantitative easing (QE) asset purchases (currently at a rate of $120 billion per month). The Fed’s current stance is that it is likely to sustain this for at least the next year or two. The Fed is forecasting core inflation of 1.8% in 2021 and 1.9% in 2022.

In 2021, inflation should get a boost from the economic recovery, and may temporarily rise above a 2% rate on a year-over-year basis compared to the depressed 2020 price levels. But inflation is unlikely to move higher absent an external shock as long as there remain high unemployment and excess economic capacity. The economy is still operating below its potential. The Fed is forecasting a 5% unemployment rate for 2021 and 4.2% in 2022.

Source: U.S. Bureau of Labor Statistics, JPMAM. Jobs lost from February to April 2020, jobs regained from April 2020 to present – as of December 31, 2020

Short-term rates should remain near zero. Longer-term government bond yields may rise moderately as the pandemic recedes and investors start to price in a more normal economic recovery cycle. The Fed has tools to contain yield increases if need be.

In summary, the economy is in the early stages of a cyclical recovery, assisted by highly accommodative monetary policy and fiscal policy. This should provide a supportive backdrop for stocks and other “risk assets” over the course of the next year.

Global Market Outlook

In an environment in which U.S. and global economies are in a synchronized early-cycle growth phase, corporate profits should be strong. Consensus estimates are for S&P 500 operating earnings growth of over 30% in 2021 after a 23% drop in 2020. The relative valuation of U.S. stocks versus bonds is attractive, and even more so for foreign stocks. Despite high absolute U.S. stock valuations, stocks look relatively cheap when compared to 1% Treasury bond yields. The risk premium for owning equities relative to bonds is high and attractive, suggesting stock should outperform bonds over a medium-term horizon.

As long as bond yields remain very low and corporate earnings growth is meeting or exceeding expectations, U.S. stocks can continue to perform well. We also see better tactical opportunities in foreign equities. Foreign equity markets should be even stronger beneficiaries of a global recovery given their generally higher cyclical sensitivity to global growth, and they have significantly lower valuations compared to U.S. equities.

Source: BEA, Factset, JPMAM – as of December 31, 2020

So, we see potential for better-than-expected earnings growth and possibly some increase in valuation multiples for stock markets outside the U.S. We remain focused on employing both offensive and defensive strategies in our portfolio construction.

The direction of the U.S. dollar is another important variable for foreign markets. When the dollar depreciates, it increases the return to dollar-based investors in foreign assets. A rebound in the global economy in 2021 should be a negative for the dollar relative to other currencies in both international developed countries and emerging markets. There are other dollar headwinds:

- With the Fed rate cuts in 2020, U.S. bond yields are less attractive than they were so there is relatively less demand for U.S. dollars;

- The dollar is expensive on a fundamental valuation basis; and

- The growing U.S. budget and trade deficit implies downward pressure.

We will maintain our gold position as a hedge against further dollar declines and also look to add to other commodities.

Fixed Income Outlook

The outlook for fixed income is relatively more certain than for equities given the tight relationship between bond market yields and total returns. Given the 1.03% current yield of the core bond index, we have a high degree of confidence that core bonds’ five-year expected returns will be in the 1% ballpark. On an after-inflation basis, their “real” yield is negative. Core bonds are unattractive on an absolute and relative basis. However, bonds still play a vital risk management role in our balanced portfolios. They provide a safe haven or anchor in the event of a recession or a shock. The pandemic was the most recent example. We maintain exposure to core bonds in our balanced portfolios, but with a meaningful allocation to other credit sectors not included in the index such as investment grade corporate bonds and mortgage- and asset-backed securities.

The Fed does not want a sharp rise in longer-term interest rates. The economy likely could not handle it, but it should be fine with a modest rise if it is in response to a stronger economic outlook. Our positions in credit-oriented fixed investments should outperform core bonds in a rising rate scenario, benefiting from their higher yields as well as potential price appreciation/yield tightening. We already saw this happen in the second half of 2020.

With core bonds likely to deliver subpar returns over the medium term, we will invest in real estate and infrastructure and other alternative strategies that have good potential to improve overall portfolio returns as well as provide valuable diversification benefits across a wide range of macro returns. Real estate investments should generate solid cash flow at attractive prices.

Closing Thoughts

Predicting the future is never a good approach. There is no crystal ball, but there are often beacons that provide signals about the direction in which we are headed. Following these signals and sticking to a disciplined approach is core to what we do. We have incorporated a wide range of outcomes in our portfolio construction for 2021. We think the base case is that the widespread distribution of vaccines will be effective in bringing the pandemic under control. This will enable the U.S. and global economies to stage a robust growth recovery off a depressed base. The recovery will be supported by ongoing highly accommodative monetary policy, keeping interest rates low. And we anticipate there will be enough fiscal aid to households and businesses to bridge the economic chasm while the pandemic continues to rage in the first part of the year.

The macro backdrop should be positive for global equities and other risk assets. Credit-oriented fixed income strategies and alternative strategies should also outperform bonds. Maintaining broad diversification across multiple asset classes remains very important, especially right now. In doing so, we believe our portfolios will be positioned to provide solid returns on our base case, while still maintaining downside protection if a more challenging scenario plays out. The beacons are there, and most are currently transmitting bright signs of hope about an economic recovery. But we are prepared to guide your investments prudently, thoughtfully, and opportunistically as events unfold, just as we did in March of 2020.

We appreciate your confidence and trust in our process and our team. We sincerely wish everyone a healthier, happier, peaceful, and prosperous 2021.

Again, we are here and ready to do our best to answer any questions you may have or to just simply talk things through at times when you feel it may be helpful. We can navigate this current together; we are here for you.