12 minute read

Financial markets had a rough third quarter across the board – stocks, bonds, U.S., international, and emerging markets – hurt by rising interest rates and inflation. After a very difficult first half of the year, equity markets rebounded briefly in July and August on investor hopes of an easing in inflation and a Fed pivot or pause. The reprieve, however, was short-lived, as stocks tumbled to fresh lows in late September amid further aggressive central bank rate hikes and statements indicating further tightening to come.

The unrelenting decline in risk assets and backup in global yields continued in the quarter, bringing the S&P’s decline from its August peak to almost -17%. Global stocks (MSCI ACWI Index) fell 6.82% for the quarter and are down 26% for the year. The S&P 500 dropped 4.9% for the quarter and is down 24% for the year. Developed international markets (MSCI EAFE Index) fell 9.4% for the quarter and 27% YTD. Emerging markets stocks (MSCI Emerging Markets Index) dropped 11.6% for the quarter and 27% YTD.

Foreign equity market returns for U.S. dollar-based investors were worsened by the sharp appreciation of the dollar. The U.S. Dollar Index was up 7.1% for the quarter and a stunning 17.3% on the year, hitting a 20-year high. These dollar gains translate into roughly comparable losses for U.S. dollar-based investors investing in international equity markets. For example, the MSCI EAFE Currency Hedged Index return this year is -13% vs. -27.1% unhedged; and the MSCI EM Currency Hedged Index has lost about six percentage points less than the MSCI EM Index unhedged (our benchmark). A reversal in the dollar would be a major tailwind for unhedged foreign equity returns going forward.

Core investment-grade bonds didn’t avoid the Q3 carnage. The 10-year Treasury yield hit a decade high of 3.97%, causing the Bloomberg U.S. Aggregate Bond Index (the “Agg”) to drop 4.8%. This puts the “safe haven” Agg down an incredible 14.6% for the year to date. In other segments of the fixed-income markets, high-yield bonds dropped 0.68% and floating rate loans gained 1.37% for the quarter. For the year to date, floating rate loans have been one of the best performers, down just 3.25%.

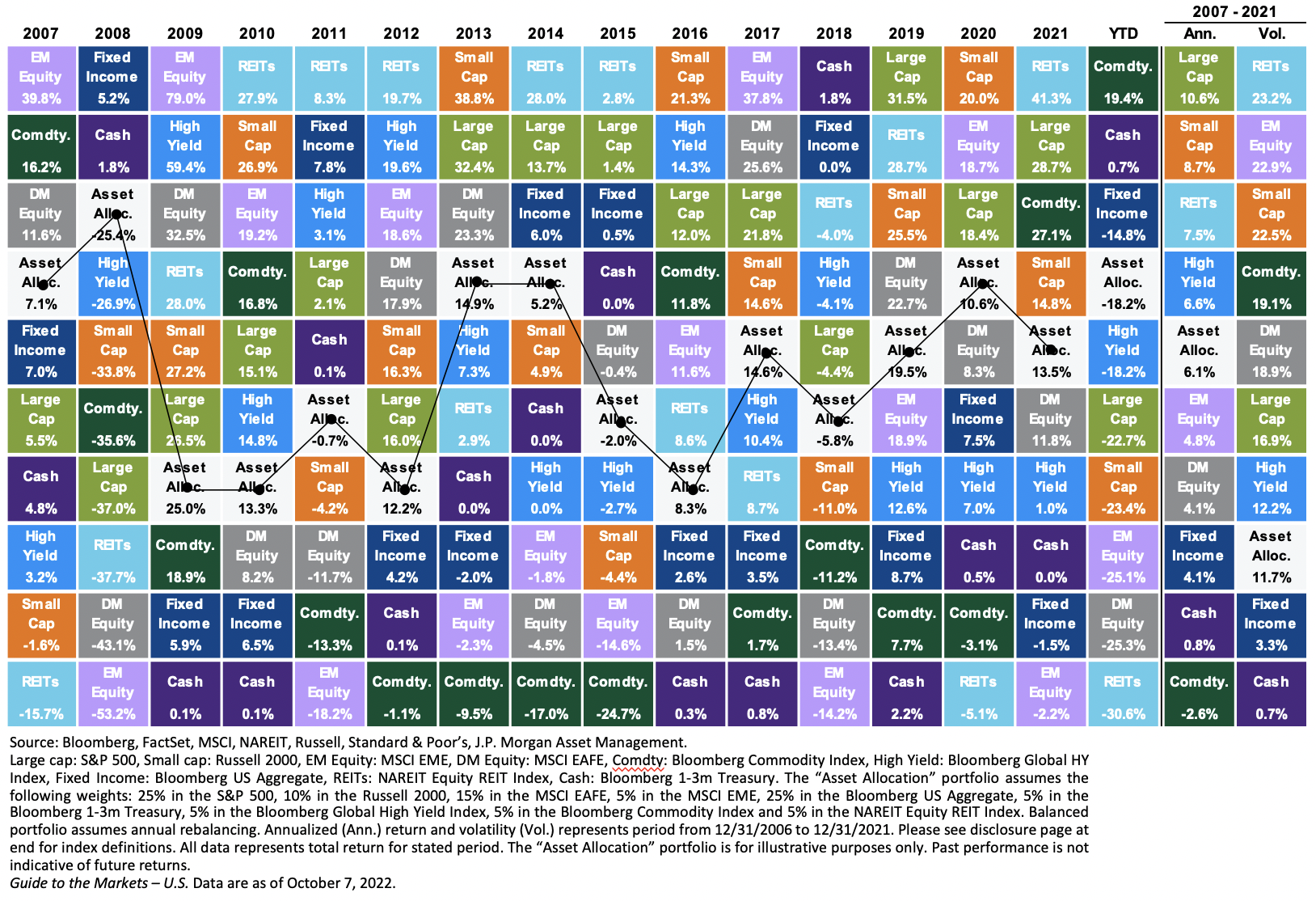

Our allocation to “nontraditional” asset classes – non-core fixed-income market segments and alternative strategies – benefited our balanced portfolios again in the third quarter. Private real estate, private credit and equity, infrastructure, and commodities have been performed well for the year, though, while being pleased with this there is no assurance it will continue. Their increase, however, has not been enough to offset the decline in public stocks and bonds for the year.

Macro Outlook: Inflation, Inflation, Inflation

The economic backdrop for the U.S. and global economy deteriorated further in the third quarter, continuing a trend we highlighted last quarter; stubbornly high inflation remains the key economic indicator. High inflation is driving U.S. and global central banks to further tighten monetary policy and hike interest rates. Central banks are raising their policy rates (the “fed funds” rate) to attempt to bring down inflation by curtailing “aggregate demand” – in other words, consumer and business spending.

The Fed’s policy hammer of higher interest rates we believe will eventually pound down GDP growth and increase unemployment. The odds the Fed can engineer an economic soft landing – where the U.S. economy slows to below-trend GDP growth with somewhat higher unemployment but does not fall into a deep recession with much higher unemployment – are increasingly slim.

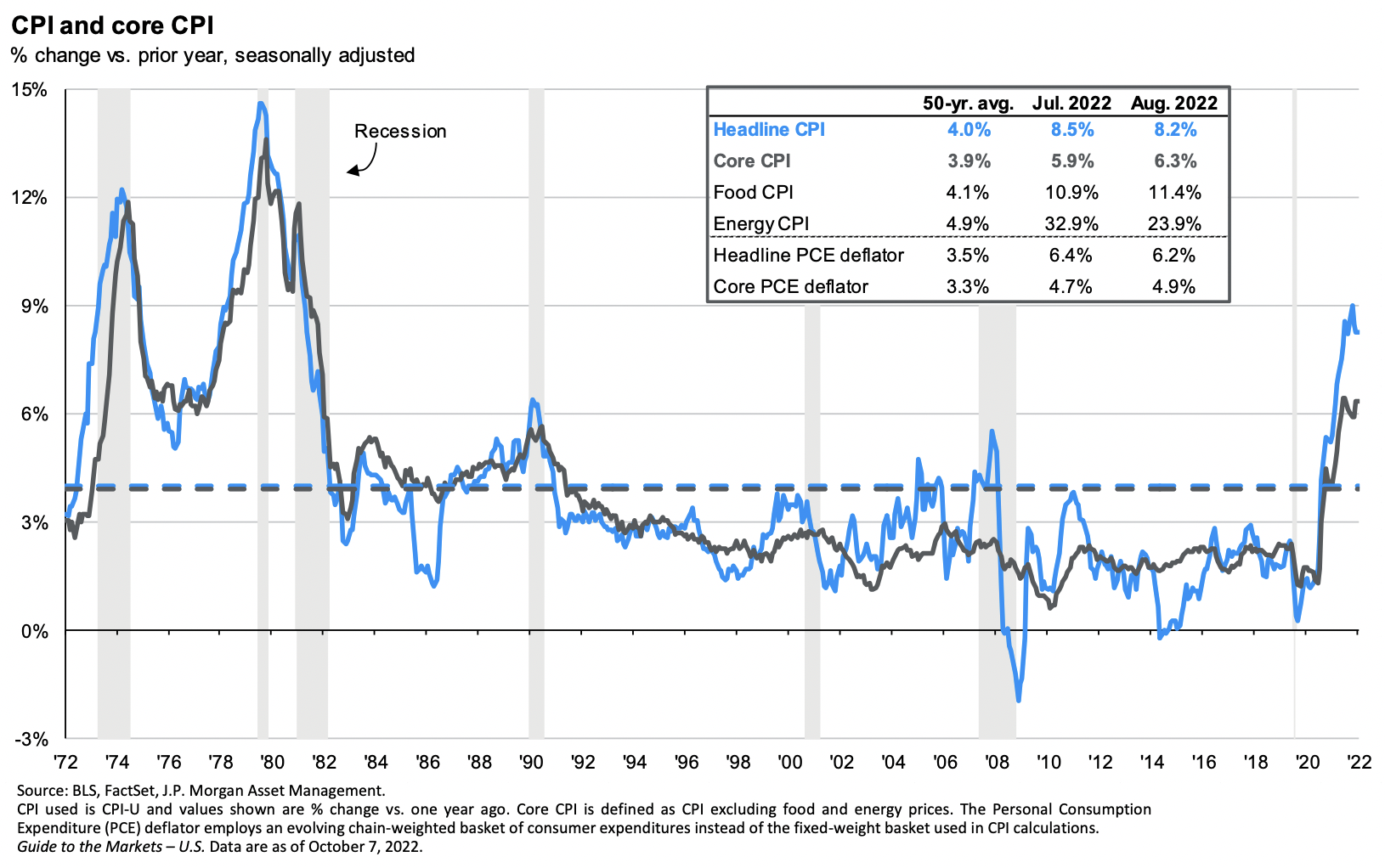

While headline CPI inflation (excluding food and energy) seems to have peaked, core inflation measures have continued to rise and are far above the Fed’s 2% target.

This indicates inflationary pressures have become more widespread throughout the economy, rather than driven by a few extreme outliers as in 2021. Some of this broad-based core inflation is still due to “transitory” COVID-related supply-side disruptions and production/distribution bottlenecks. Central banks can’t do anything about these short-term supply-side inflationary forces. But the good news is that many of these supply-chain disruptions are dissipating as the pandemic recedes globally. China’s ongoing zero-COVID lockdown policy has been the exception, but that is also easing.

However, the demand-side drivers of core inflation in the U.S. have not yet peaked, let alone demonstrated the consistent month-over-month declines that Fed Chair Jerome Powell says the Fed is looking for as “clear evidence” inflation is headed to the Fed’s 2% target.

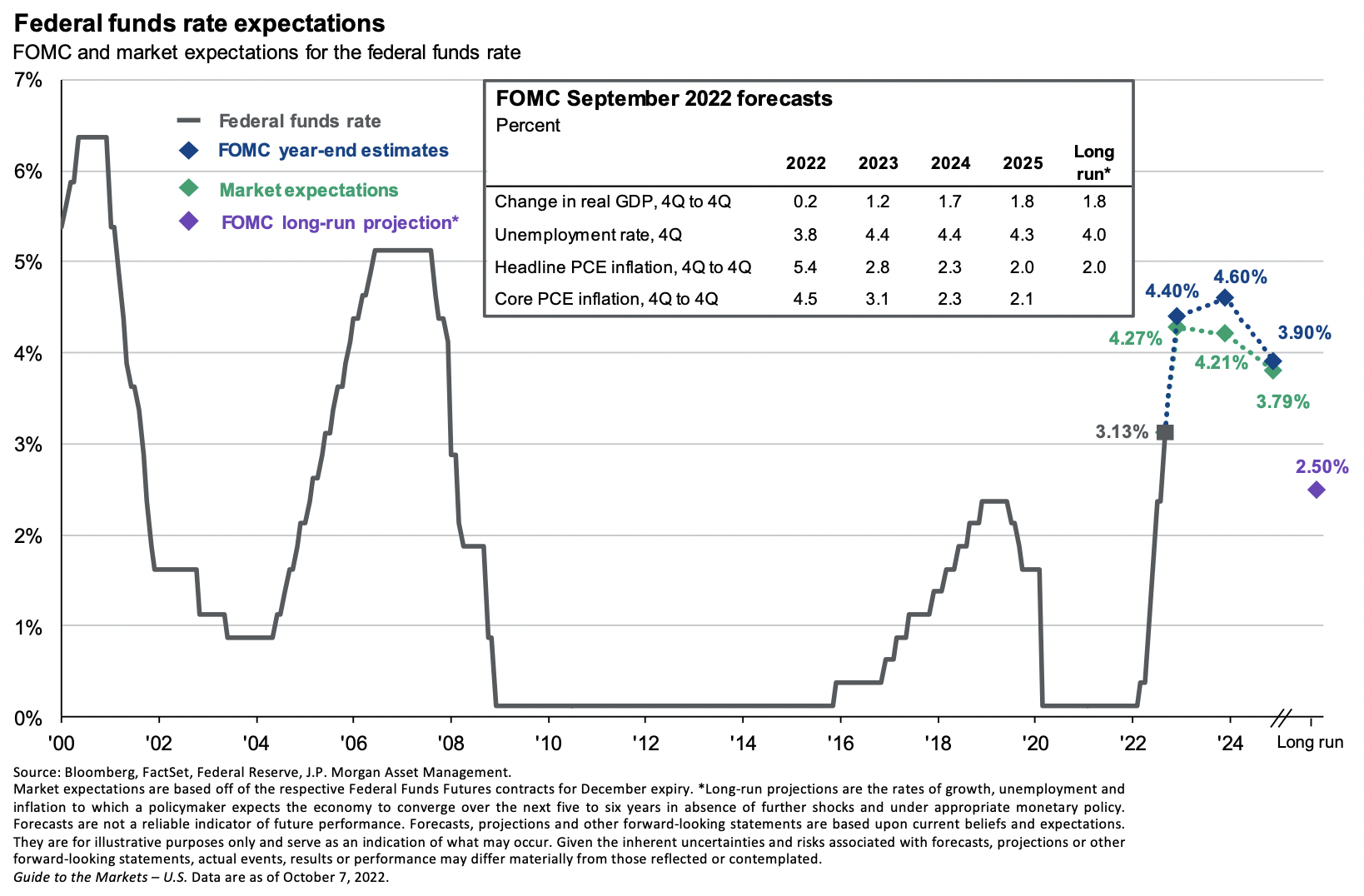

As such, and as expected, at its September 21 meeting, the Federal Open Market Committee (FOMC) raised the fed funds rate by 75 bps to a target range of 3% to 3.25%. The FOMC’s new median forecast is for another 125 bps (1.25%) increase over the committee’s next two meetings, in November and December, ending the year between 4.25% and 4.5%.

The FOMC also sharply cut its GDP growth forecast to just 0.2% for 2022, and a sub-par 1.2% in 2023. The long-term trend U.S. GDP growth rate is estimated to be around 2%, based on expected U.S. labor force and productivity growth rates.

It’s worth noting that just nine months ago, at its December 2021 meeting, the FOMC’s median forecast was for the fed funds target range to be 0.75%-1% at the end of this year, with real GDP growth a very strong 4%. The Fed made a major policy mistake in its forecast and is now trying to fix its mistake. It’s very difficult to predict key macro-economic variables consistently and accurately over time.

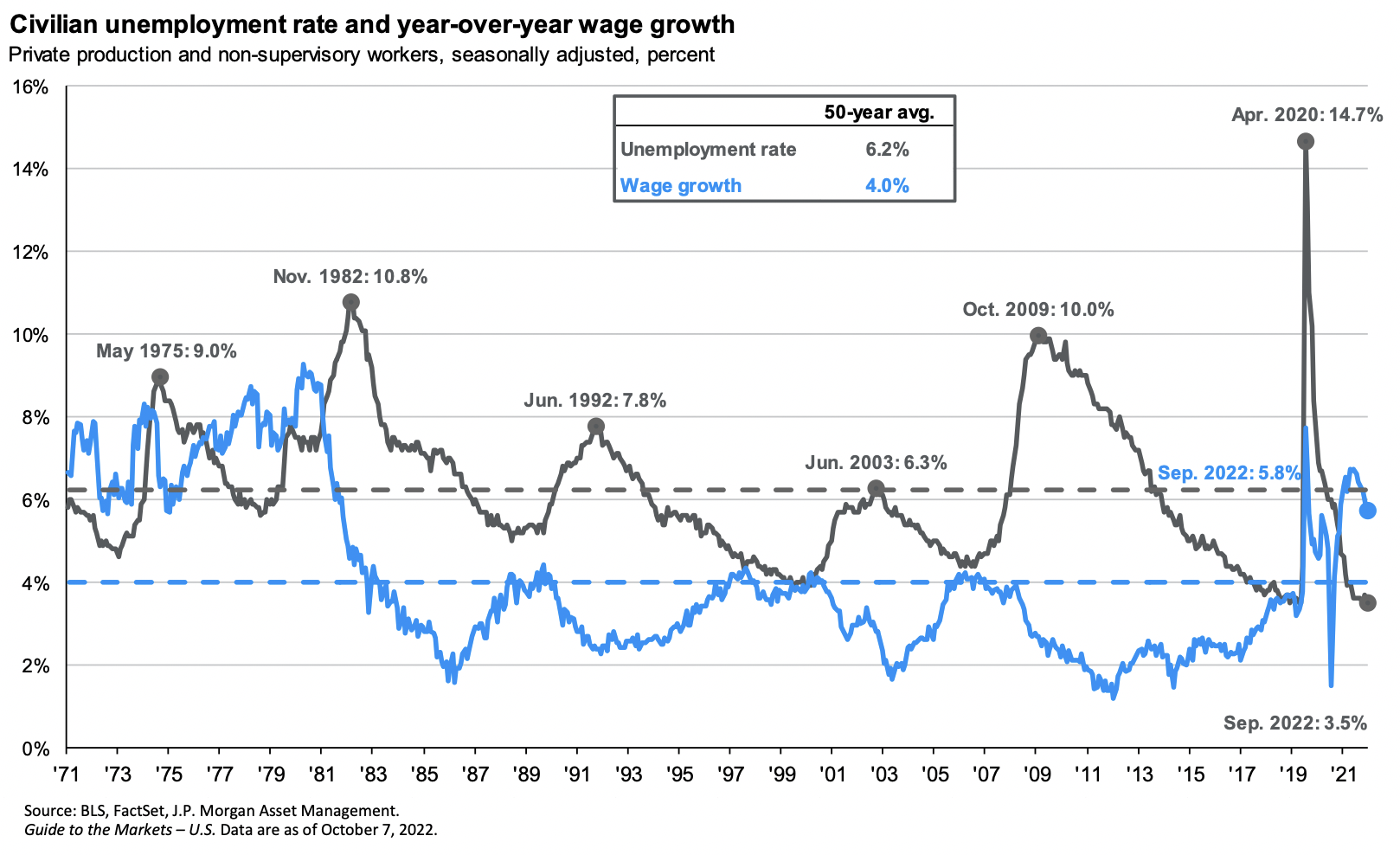

In addition to higher rates and lower growth, the FOMC also increased its unemployment rate forecast for next year to 4.4%; if that plays out, history suggests a recession is likely. Since 1950, there has never been an instance where the U.S. unemployment rate has increased by a half percent or more from its cycle low without an accompanying recession. The unemployment rate bottomed at 3.5% in July and October.

Two key inflation variables the Fed is focused on are (1) the labor market – wage inflation specifically – and (2) inflation expectations. The data here continue to be mixed.

Wages

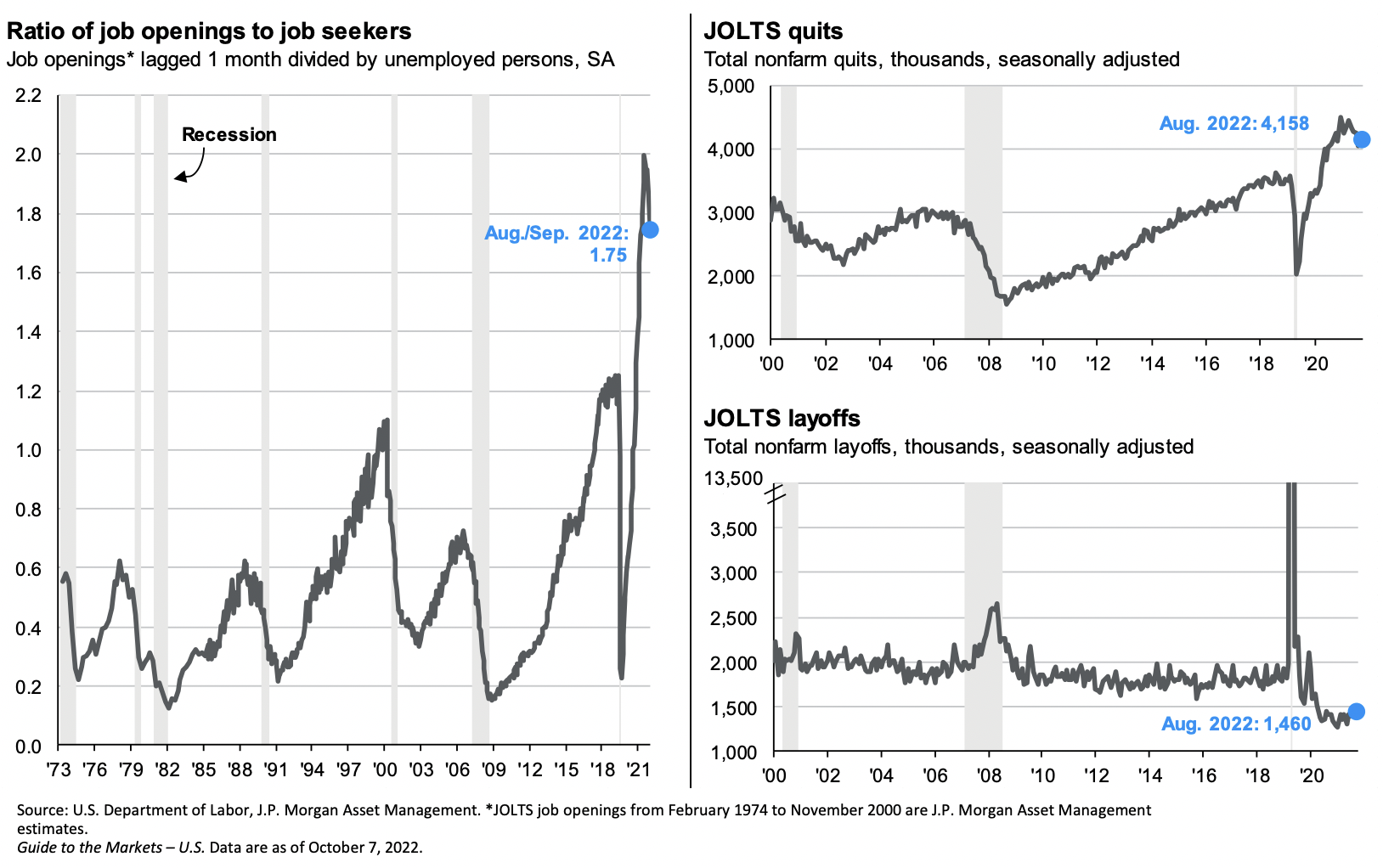

U.S. wage growth (wage inflation) is high and still rising. The U.S. labor market remains very tight. The 3.5% unemployment rate is near all-time lows, while the ratio of job openings to unemployed workers looking for a job remains near all-time highs. This suggests continued wage pressure is likely at least until the labor market weakens, which is the Fed’s aim, despite some tentative signs of labor market cooling (JOLTS in particular) and some easing of demand growth (see the NY Fed weekly).

Investors continue to fear a service economy that is too hot relative to a tight labor market. CPI could alleviate some of those fears in October, and we have a high conviction that economic growth will slow much more quickly starting now. The trend has turned everywhere.

Inflation Expectations

On the positive side, consumer surveys and market-based measures suggest medium-to-longer-term inflation expectations remain well-anchored, consistent with the Fed ultimately achieving its 2% core inflation objective. Short-term inflation expectations, which are highly sensitive to gas prices, have also dropped recently.

Inflation expectations are crucial, because if they become less stable, they can feed into a self-perpetuating, inflationary wage-price spiral, where wage and price hikes feed back into higher inflationary expectations, which feed into further wage and price hikes, etc. This was essentially the inflationary regime that Fed Chair Paul Volcker had to break in the early 1980s. One huge difference (among many) between now and then is that medium-to-longer-term inflation expectations reached double digits in Volcker’s time – requiring a double-digit fed funds rate to ultimately crush – versus their 2%-3% range today.

Inflation is not just a U.S. problem. Nearly all global central banks (except Japan and China) are raising their policy rates to fight inflation in their countries. This will depress global aggregate demand and economic growth over the shorter term.

Economic Growth

In our second-quarter commentary, we wrote that recession risks have risen – the shorter-term growth outlook has worsened in the third quarter for the U.S. and the globe. The risk of a recession continues to rise. We highlight two widely followed economic indicators that are published monthly: the Purchasing Managers’ Index (PMI) and the Conference Board’s Leading Economic Index (LEI). Both measures continued to deteriorate in the third quarter and are now signaling that a recession is likely coming down the pike.

We put weight on the LEI. In addition to the magnitude of its recent decline, the LEI has dropped for six straight months. That has never happened before without a recession.

The Treasury yield curve is inverted, meaning shorter-term yields are above longer-term bond yields. An inverted yield curve is unusual and usually a leading indicator of recession. The 2-year/10-year yield curve is strongly inverted at -50 bps. This degree of inversion has never occurred without a subsequent recession and is another piece of the puzzle.

Finally, the fed funds target rates of 4.4% at year-end and 4.6% by early 2023 are well above the neutral rate of 2%. And if those rate levels are not high enough to bring down inflation sharply, Powell and the Fed have made it clear they will keep tightening until they get there.

Big picture: Balancing these and many other data points, our base shorter-term (6-12 month) economic outlook on the U.S. and global economy is for continued deceleration in economic growth driven by rapidly tightening monetary policy in response to sustained high inflation. A recession is likely but not a certainty. WE are not economic forecasters. Much more relevant for us as investors is assessing the potential severity of any economic slowdown/recession and its impact on corporate earnings and interest rates and what is being discounted in asset prices. Our best guess at this point is that if the U.S. economy does fall into a recession, it is likely to be a more “normal” type of cyclical recession rather than one like the 2008-2009 financial crisis, the 2000-2002 dot-com bubble bust, or the 2020 COVID recession. Our confidence about the severity of a recession is not sufficiently high for us to have made a further move to reduce our stock exposure based on a recession bet. However, we have increased our allocation to Treasuries and municipal bonds. The sharp stock and bond market decline we’ve already experienced this year leads us to a relatively positive medium-term (5-year) outlook for financial markets asset class returns.

Financial Markets Outlook and Our Portfolio Positioning

We face plenty of issues today, but rather than assume a severe recession will play out, we expect this to be a more typical cyclical recession, where central bank (and fiscal) tightening in response to an overheating economy and rising inflation ultimately trigger a bear market and economic downturn. Nevertheless, one might ask why we are not tactically reducing our equity exposure further, given that we view the risk of recession as materially higher now than a few months ago. The answer is that we believe stock markets in the U.S. and abroad have largely already priced in this risk with year-to-date declines of 20%-30%. As we’ve often stated, the key question for a fundamental investor is “What’s in the price?” Valuations look attractive for U.S. stocks at these levels.

If so, that should set the stage for a subsequent cyclical recovery. As we pointed out in our last commentary, the market can have robust returns 1 and 3 years after a recession. Our current moderate “all weather” portfolio positioning should perform well in a recovery. As we wrote in late June, our base case 5-year expected return range for the S&P 500 is 7%-12% annualized. This is in line with our long-term expectations for U.S. stocks though, of course, there is no guarantee of it occurring.

Developed International and Emerging Markets

Our views on international and EM stocks have changed modestly. These markets have declined largely in line with U.S. markets this year. Our base case 5-year expected returns for EM and developed international stocks are in the low double digits, supported by low starting valuations and cyclically depressed earnings. Things don’t have to become great for international and EM stocks to generate strong returns from here – they just need to get better from currently depressed levels.

The U.S. dollar strength remains a headwind for foreign stocks’ returns to dollar-based investors. We expect the dollar to remain strong in the short term and economic risks to remain elevated in Europe and as a result are modestly underweighting developed international and EM markets and keeping our slight overweight to U.S. equities. The monetary easing signal may also be the catalyst for a broad global rally. In that case, we would expect EM and developed international stocks to outperform the S&P 500, boosted by the tailwind of a depreciating U.S. dollar but also by those markets’ generally higher sensitivity (beta) to cyclical global conditions compared with the U.S. market. We need a Fed policy pivot and a decline in the U.S. dollar for global equities to outperform.

Fixed Income

Coming into this year, we had a significant underweight to core bonds, reflecting concerns about rising interest rates and very low starting yields. However, with the sharp rise in core bond yields to above 4%, that has changed. With the recent rise in Treasury and municipal bond yields to levels not seen since 2018, and prior to that, 2009, we have significantly increased core fixed income in our strategies by purchasing high-quality municipal bonds and Treasury bonds while reducing our credit strategies. Credit strategies performed well during rising interest rates, and now we have tactically shifted those positions into high-quality core fixed income.

With their higher current yield, core bonds now also offer better portfolio stability and shorter-term return potential in a recession scenario. For example, if the 10-year Treasury yield were to decline 75 bps (to 2.75%) over the next 12 months, we estimate the core bond index (the Agg) would return 8% (from yield plus price gains). That would provide great portfolio downside protection if equities were to drop further. Even if Treasury yields rise 75 bps from here, we estimate the Agg would still be slightly positive. We will continue to add to these positions as interest rates rise. While we are confident in our investment approach, we cannot be certain of the interest rate scenario that will play out or if or when portfolio profits will be recognized.

Alternative Strategies

Our alternative strategies have been the bright spot in our globally diversified portfolios so far in 2022. Alternatives add diversification to stocks and bonds and improve risk-adjusted returns of balanced portfolios. Alternatives have different risk and return drivers than do traditional stock and bond investments. Given current macro risks and market backdrop, we think they are especially valuable.

We favor private real estate investment allocation in multifamily, industrial, and self-storage for portfolios that do not have liquidity or daily valuation constraints. We expect equity-like long-term returns from these investments with built-in inflation protection and tax-efficient income generation. We also favor private equity and credit investments. We have eliminated our gold, commodities, infrastructure, and merger arbitrage and repositioned those investments into Treasuries and municipal bonds.

Closing Thoughts

In the near term, we think it is prudent to expect more equity volatility as an economic slowdown and potential recession will likely lead to slowing corporate earnings. Rest assured, we are carefully watching the current developments and will make changes when they are needed. We will take advantage of any price declines to improve our portfolio positioning.

Our globally balanced strategies remain positioned with (1) a small overweight to U.S. large stocks, (2) core positions in alternative strategies, and (3) a significant increase to core fixed income versus prior quarters. Our portfolios remain strategically balanced and well-diversified across multiple global asset classes and investment strategies.

As always, investment discipline and patience – staying the course and remaining invested through these choppy waters – are necessary to be able to realize the better future returns. Given the wide range of potential outcomes, risk, and unknowns, portfolio diversification beyond traditional stocks and core bonds remains important.

We sincerely thank you for your confidence and trust in us, and please do not hesitate to reach out if you have any questions, comments, or concerns.