Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Another week, another closing high for Financial markets; upbeat and looking past the near-term risks associated with the ongoing health crisis. The ‘reopening trade’ that started with positive vaccine news continued into the fourth week, while renewed hopes of an additional fiscal package added fuel to the fire. Vaccine optimism, solid earnings reports, tailwinds from persistently low-interest rates, and a fear of missing out on the rally have all contributed to an early, so-called ‘Santa Rally.’

Historically, strong Novembers have been followed by positive Decembers, and markets seem willing to continue the tradition this year. Investors, Politicians, and Central Banks are all compliant. Global M&A is even picking up, with several merger deals announced this week – S&P Global (SPGI) plans to buy IHS Markit (INFO) for $44 billion, salesforce.com (CRM) will acquire Slack Technologies (WORK) for $27.7 billion, and Australia’s Macquarie Group is buying U.S. wealth manager Waddell & Reed (WDR) for $1.7 billion. CEOs looking beyond the current environment and focusing on their long term prospects is yet another tick in the column for optimism to close out the year. However, the price-to-pay for this ‘Santa Rally’ is that the market is likely stealing returns from 2021 and beyond. Given all the hurdles that markets have overcome this year (COVID impacts, U.S./China tensions, election uncertainty, and Capital Market illiquidity, to name a few) and the increasing likelihood of additional fiscal support in December, what low-hanging catalyst fruit is left to help propel markets higher in the near term?

Deteriorating economic momentum will be the critical theme for market participants as we head into the new year. The striking deceleration in the November jobs report forbade that a tough slog lay ahead for the U.S. economy amid renewed COVID-19 lockdowns. As such, upcoming data on small business sentiment (Tuesday), unemployment insurance filings (Thursday), and household sentiment (Friday) will take precedence over lagging indicators of activity, such as consumer and producer prices this week.

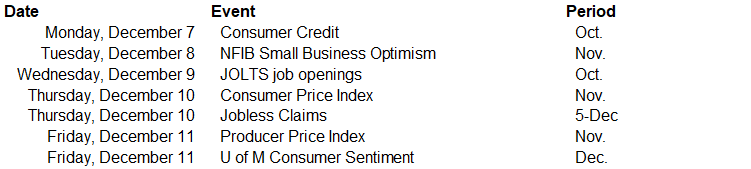

Data deck for December 5–December 11: